Airtable: From Startup to $11 Billion Unicorn

Every year, businesses invest millions of dollars into a simple yet elusive goal: making sense of their data. Across industries, teams rely on data to drive decisions, track progress, and forecast growth, but the tools they’re using—like Excel and Google Sheets—were never built to handle the complexities of modern business operations. As companies grow and data becomes more intricate, traditional spreadsheets start to break down, leaving teams frustrated and burning resources just to keep things running smoothly.

To cope, businesses have turned to external tools like Tableau, Power BI, and Looker to create visually appealing dashboards and generate custom reports. These platforms allow for more advanced data visualization and analysis, but at a steep cost. The software itself is expensive, but the real expense lies in the specialized knowledge required to implement and maintain these systems. Entire teams or expensive consultants are brought in to manage the integration of data sources, ensure data accuracy, and create meaningful visualizations that drive decisions.

And yet, despite these efforts, the struggle persists. Data from multiple sources still has to be manually entered into systems or connected through fragile integrations, and as data scales, so do the risks—errors creep in, and maintaining these systems becomes a time-consuming, costly endeavor. For many companies, this is just the cost of doing business. But does it have to be?

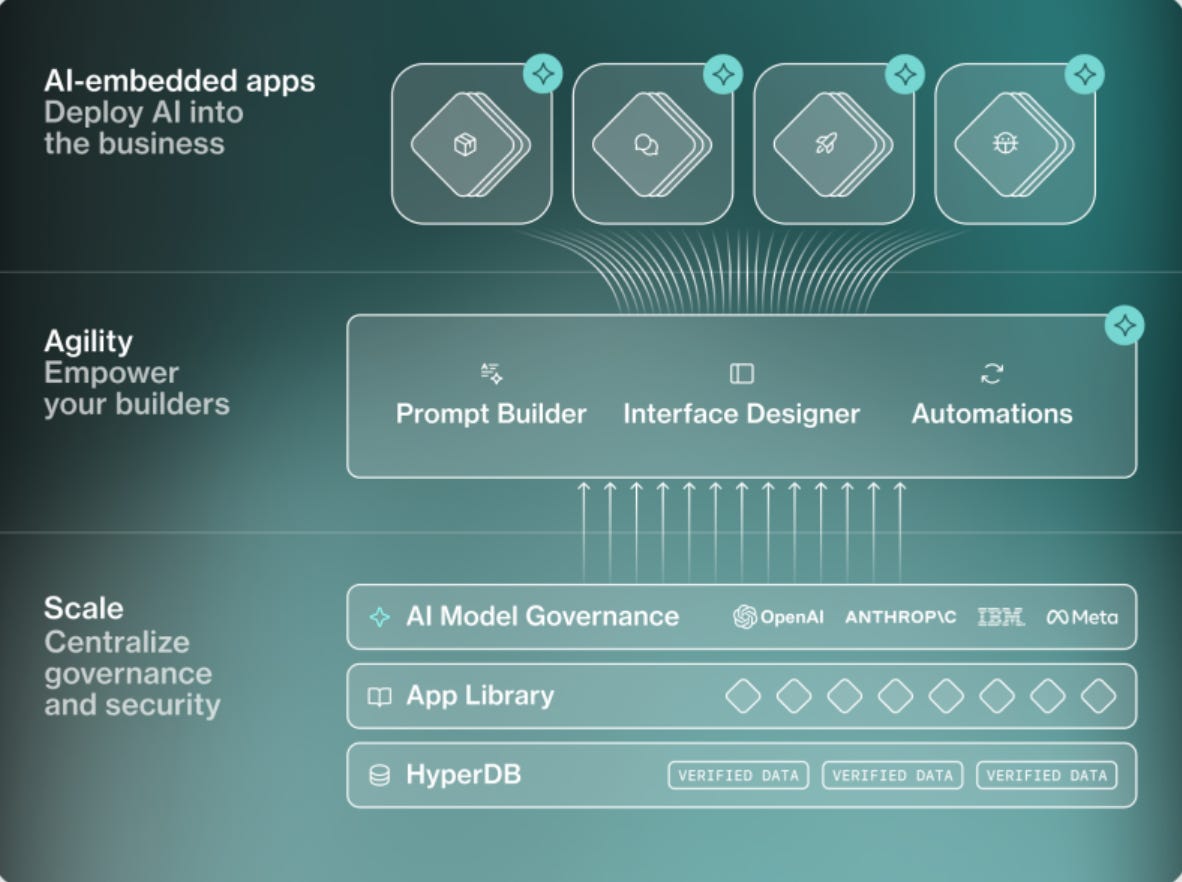

Airtable: Simplifying Data Management and Slashing Costs—All in One Platform

Enter Airtable—a platform that’s reshaping the way businesses handle and visualize their data. Think of it as the best of both worlds: the familiarity of a spreadsheet combined with the power of a relational database. Whether you're managing complex workflows, creating dynamic dashboards, or automating tasks, Airtable brings everything together in one easy-to-use platform. And the best part? You might no longer need those expensive tools like Tableau or Power BI for most of your everyday data needs, cutting down on costs and simplifying your operations.

Imagine being able to build customizable dashboards and interactive reports without needing a team of developers or having to buy costly software licenses. Airtable makes that possible. Unlike the traditional tools that require constant upkeep and troubleshooting, with Airtable, you can create, share, and manage data in real-time—all without needing advanced technical expertise. Plus, data gets automatically synced across your team, so no one is working off outdated information. Everyone’s on the same page, working from a single source of truth.

Here’s what Airtable lets you do:

Say goodbye to expensive third-party tools like Tableau, Power BI, or Looker for your day-to-day data visualization needs.

Eliminate manual data entry and fragile integrations by automating workflows and syncing data across your departments.

Build and customize dashboards and reports easily, without needing to hire a developer, saving you thousands of dollars in labor and software costs.

If your business is managing complex operations, moving to Airtable can save you tens of thousands of dollars every year. You’ll be cutting out software redundancies and won’t need as many specialized data teams. The financial impact is huge, but what’s even more valuable is how Airtable enables your team to act faster, with real-time insights and a more streamlined data management process.

The Journey of Airtable's Founders – From Idea to Execution

Airtable was born out of a desire to simplify how businesses manage data, and at the heart of this innovation is Howie Liu, a serial entrepreneur with a passion for solving complex problems. Liu, along with co-founders Andrew Ofstad and Emmett Nicholas, envisioned a tool that combined the simplicity of a spreadsheet with the capabilities of a database—making it accessible to anyone, regardless of technical expertise.

Liu had already experienced success in the startup world before founding Airtable. In 2010, he built and sold a CRM startup called Etacts to Salesforce, which gave him deep insight into how businesses were struggling with data management. He noticed that while spreadsheets like Excel were widely used, they weren’t equipped to handle the complex, interconnected data businesses needed to manage.

Both Ofstad, who previously led the redesign of Google’s Maps interface, and Nicholas, a former engineer at Stack Overflow, brought technical expertise to the team. Together, they set out to create a tool that felt familiar but was more powerful, with flexibility that traditional databases lacked. Their goal was to put the power of customization in the hands of users, enabling teams to build workflows without needing a developer.

However, the journey wasn’t without its struggles. Launching a new kind of software in an already crowded market wasn’t easy, and the founders faced challenges in convincing users that something as simple as a spreadsheet could be reimagined into a much more powerful tool. Early on, they had to iterate quickly, responding to user feedback while ensuring that Airtable remained intuitive and accessible.

Launched in 2013, Airtable gained traction for its user-friendly design and flexibility, quickly becoming a go-to tool for businesses of all sizes. The founders' ability to identify a real gap in the market—bridging the worlds of spreadsheets and databases—was key to Airtable’s success.

Airtable’s Market Entry and Gaining Traction

Airtable’s entry into the market was not just a matter of offering a new tool—it was about strategically positioning itself at the intersection of flexibility, usability, and power. While many tools claim to be transformative, Airtable took deliberate steps to differentiate itself in a saturated space. Here's an analysis of how Airtable gained traction beyond the obvious strategies.

Timing and Market Readiness

When Airtable launched in 2013, it entered a market that was primed for disruption. Businesses had been using Excel for decades, but as workflows became more complex, it was clear that traditional spreadsheets couldn’t keep up. Many organizations were feeling the strain of disconnected data, inefficient workflows, and siloed teams, yet they didn’t have a user-friendly alternative to Excel.

Airtable recognized that the market was ready for a solution that offered customization without complexity. Instead of forcing businesses to adopt rigid project management tools or complex database systems, Airtable met them where they were—offering a tool that felt familiar, but that could scale with their needs. This was a masterstroke: Airtable wasn’t forcing a change in behavior; it was enhancing what people were already doing.

The Democratization of Database Power

One of Airtable’s key differentiators was its ability to democratize the power of databases. In the past, databases were viewed as something only IT departments or developers could manage. Airtable turned this on its head by giving non-technical teams the ability to create and manage relational databases without needing to understand complex queries or technical setups. This shifted Airtable from being just a productivity tool to being a platform for innovation.

By empowering users to design their own workflows—whether they were in HR, marketing, or operations—Airtable unlocked creativity in how businesses managed data. This democratization also built a sense of ownership among users, driving adoption within teams as individuals could create systems that worked specifically for them. This level of flexibility became one of Airtable's strongest competitive advantages.

Product-Led Growth with a Twist

Airtable employed a product-led growth (PLG) strategy, where the product itself became the primary driver of user acquisition and retention. But what set Airtable apart from many PLG companies was its focus on building for the end-user, not the IT team. Instead of pushing enterprise-wide adoption from the top-down, Airtable focused on winning over small teams and individual users first.

The free tier allowed teams to start using the platform at no cost, fostering experimentation and building trust. As these small teams found success, the tool organically spread throughout organizations, often becoming indispensable for broader operations. This is what makes Airtable’s “land-and-expand” model particularly effective—it relied on users proving the value of the tool to their peers rather than traditional sales tactics.

Positioning as More Than a Tool—A Platform

Airtable didn’t just position itself as an improved spreadsheet or a lightweight database. It strategically positioned itself as a platform that could serve multiple business functions. Whether you were using it for CRM, project management, content planning, or even app development, Airtable became a versatile, multi-functional platform that users could adapt to their specific needs.

This broad applicability across industries and departments made it more than a one-use tool—it became a system that could grow alongside a company. As organizations evolved, Airtable’s flexibility ensured it could continue to serve them without needing to move to more expensive or specialized systems.

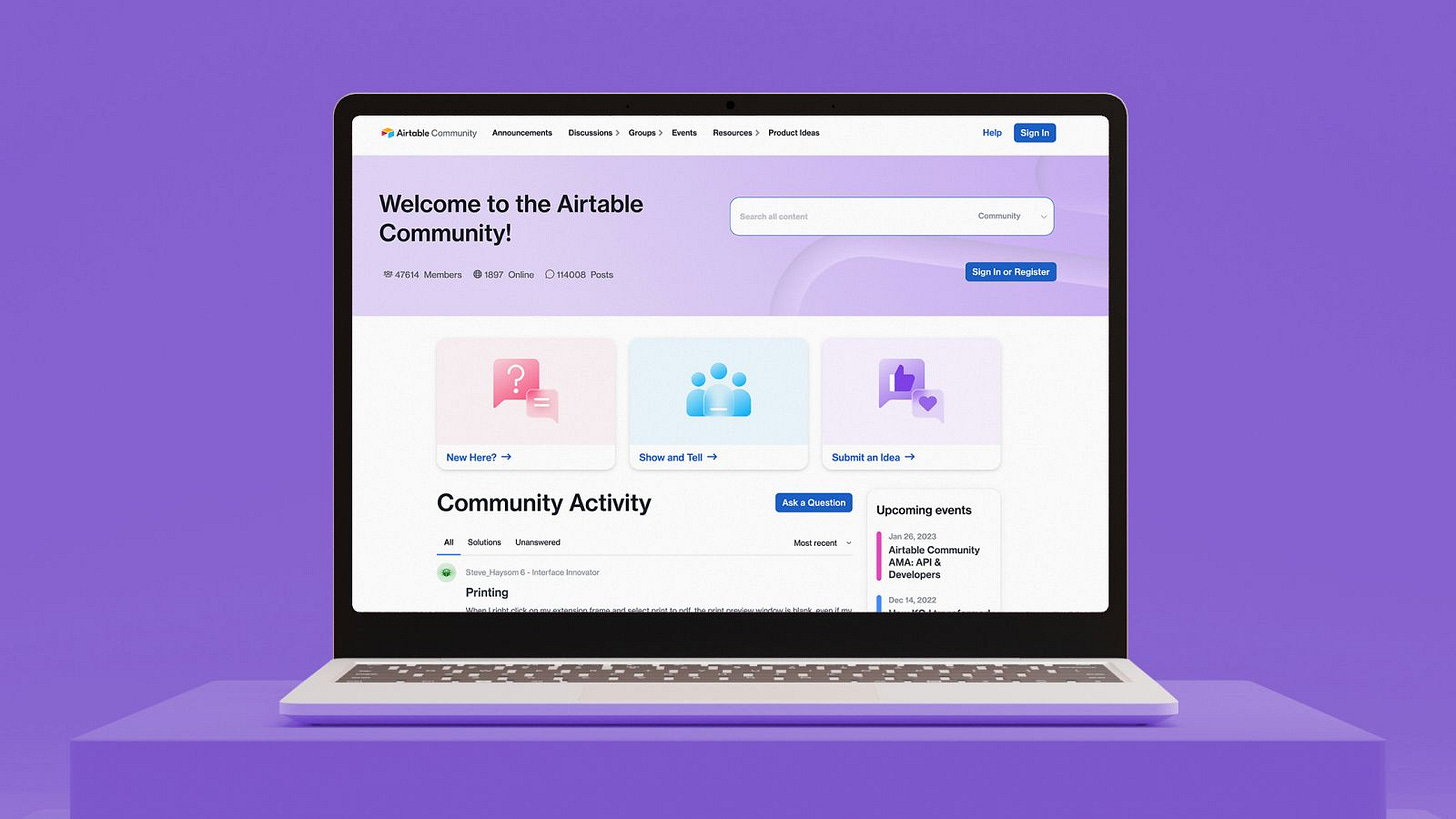

Building a Community-Driven Ecosystem

Another critical component of Airtable’s growth strategy was its focus on building a community-driven ecosystem. While other platforms were developing ecosystems focused on developers or IT professionals, Airtable made a concerted effort to create content, guides, and case studies that spoke directly to its end users—those managing marketing campaigns, designing product roadmaps, or planning events.

By creating an ecosystem that empowered everyday users to share their experiences and use cases, Airtable fostered a community of evangelists. This organic advocacy led to Airtable becoming a go-to recommendation within teams, industries, and online communities. People weren't just using Airtable—they were showcasing their innovative use cases, which inspired others to adopt the platform.

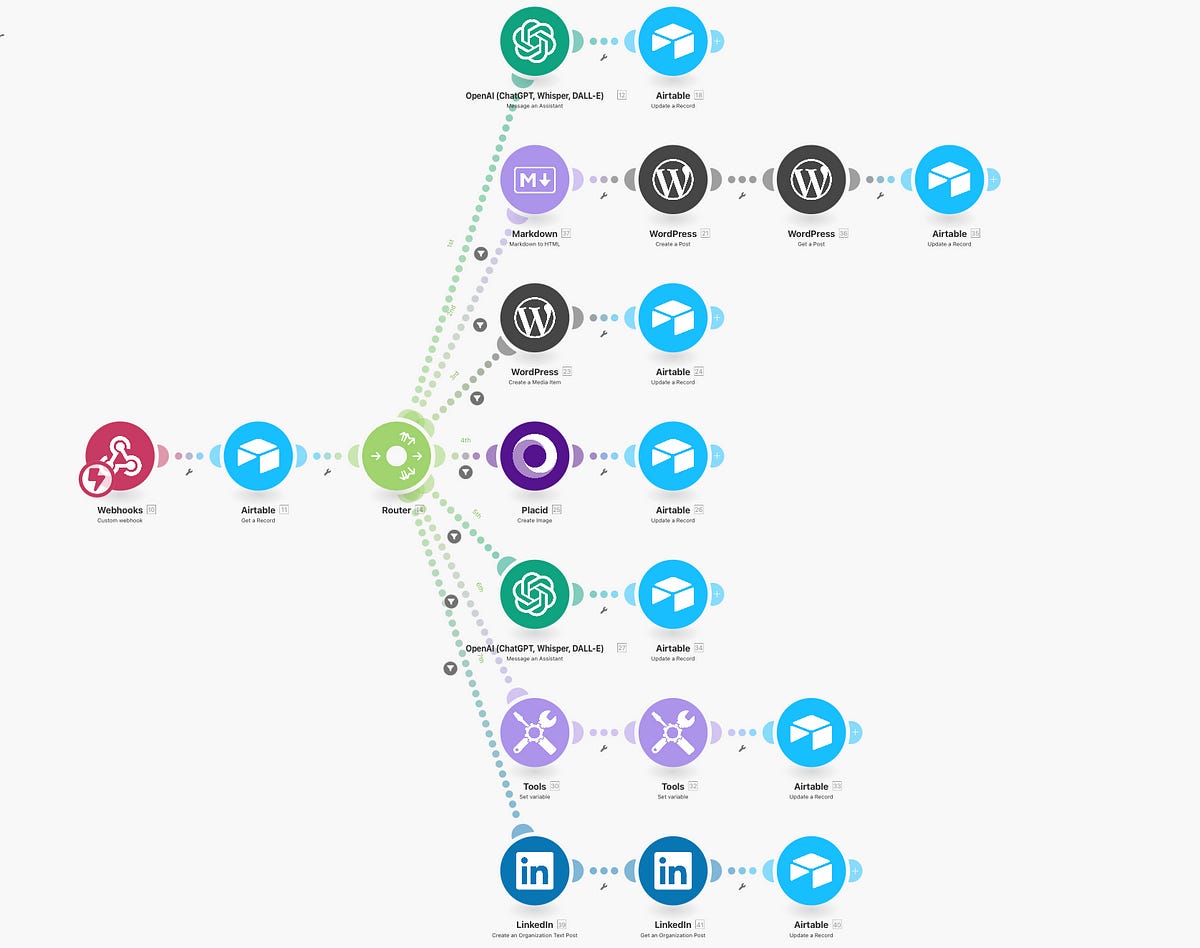

Integrations: Reducing Friction, Increasing Stickiness

Airtable’s integration strategy was another subtle yet effective tactic. By integrating seamlessly with tools like Slack, Zapier, and Google Drive, Airtable reduced the friction for new users coming from traditional systems. This wasn’t just about convenience—it was about becoming an integral part of existing workflows.

Rather than forcing users to uproot their current systems, Airtable allowed businesses to keep using the tools they were familiar with while adding significant value through seamless integration. This integration strategy made Airtable stickier—once teams started using it alongside their other tools, it became difficult to imagine going back to disconnected systems.

Major Companies That Have Adopted Airtable

As Airtable's reputation grew, many well-known companies across industries began integrating it into their workflows. Airtable’s ability to blend the simplicity of spreadsheets with the power of databases made it a go-to tool for companies looking to streamline operations, foster collaboration, and manage complex projects. Here are some notable companies that have made the switch to Airtable, and when they did:

Netflix

Netflix adopted Airtable in 2018, primarily to manage its fast-paced content production workflows. With hundreds of shows and movies in production at any given time, Netflix needed a flexible tool to track production timelines, coordinate across teams, and ensure everything stayed on schedule. Airtable’s highly customizable workflows allowed them to manage everything from casting to post-production, making the entire process smoother and more efficient.

Shopify

Shopify, the e-commerce giant, started using Airtable around 2017 to manage its marketing campaigns and track operational projects. The company needed a tool that would scale as rapidly as its business, and Airtable’s ability to adapt to changing needs without requiring custom software development made it an ideal choice. Today, Shopify uses Airtable to manage cross-functional teams working on various campaigns and product launches, making it a critical part of their internal infrastructure.

Time Magazine

Time Magazine turned to Airtable in 2019 to modernize its editorial workflows. As one of the longest-running publications in the world, Time needed a tool that would allow them to organize editorial content, track deadlines, and manage a complex publishing calendar. With Airtable, they transformed their editorial process, improving team communication and streamlining the way content moves from concept to publication.

WeWork

WeWork adopted Airtable in 2018, during a period of rapid expansion. The company needed a tool to manage real estate development projects, track build-outs, and manage the operation of their global co-working spaces. Airtable became essential for linking different data sets—such as real estate, construction timelines, and design elements—allowing WeWork to keep every team aligned in real-time, across different regions.

Medium

Medium, the popular online publishing platform, integrated Airtable into their workflows in 2020 to manage editorial and content strategies. As the platform grew, it became increasingly important for Medium to keep track of a large volume of content and contributors. Airtable enabled them to manage article assignments, track content themes, and oversee editorial deadlines, providing the flexibility Medium needed to scale their content production seamlessly.

BuzzFeed

BuzzFeed began using Airtable in 2019 to streamline its content production and editorial calendar. With a vast array of content across multiple platforms, BuzzFeed needed a tool to assign tasks to content creators, manage campaign schedules, and keep track of everything from video production to social media content. Airtable’s ability to organize complex data sets helped BuzzFeed remain agile and efficient while scaling its media operations.

Giant Spoon

The creative marketing agency Giant Spoon turned to Airtable in 2017 to help manage their growing list of clients and campaigns. The tool allowed them to keep track of client projects, deadlines, and creative assets, all while managing multiple stakeholders. Airtable became the backbone of their project management system, allowing the agency to focus on delivering innovative campaigns without being bogged down by complex software.

Stack Overflow

Stack Overflow, one of the largest online communities for developers, began using Airtable in 2019 to organize internal projects and manage team workflows. They wanted a tool that allowed for flexibility in tracking their ongoing projects without the rigidity of traditional project management tools. Airtable’s customizable views and real-time collaboration features were a perfect fit for Stack Overflow’s fast-moving teams, enabling smoother communication and project visibility.

How Companies Started Using Airtable Without Direct Outreach

One of the most intriguing aspects of Airtable’s growth is how major companies started using the tool without being directly approached by the Airtable team. Airtable’s strategy of letting the product speak for itself played a significant role in its widespread adoption. Here's how it happened:

The Power of Product-Led Growth

Airtable’s product-led growth strategy meant that the platform was designed to be so intuitive and valuable that users would naturally recommend it to their peers. With its free tier, individuals and small teams could start using Airtable with no financial risk, allowing them to experiment with its features and see its potential firsthand.

As employees in various departments—whether in marketing, operations, or content production—discovered how Airtable could streamline their workflows, they began using it on a small scale for specific tasks. As more team members saw its value, it started spreading organically within companies, often expanding from small teams to entire departments. This natural adoption created an internal push for the tool, without any sales outreach from Airtable itself.

Word-of-Mouth Advocacy

Airtable grew largely through word-of-mouth recommendations. As individual users experienced the platform’s flexibility and effectiveness, they shared their success with colleagues and peers. Whether it was in informal settings, during cross-departmental meetings, or through online communities, users began recommending Airtable as a solution to shared problems.

For example, a marketing team might introduce Airtable to manage campaign tracking, and soon the product or sales teams would hear about its success and start using it for their own projects. This created an internal network effect, with more teams adopting the tool without any direct outreach from Airtable.

Integration with Existing Workflows

Another critical factor in Airtable’s organic adoption was its ability to seamlessly integrate with tools that companies were already using, such as Slack, Google Drive, and Zapier. Employees didn’t have to overhaul their entire workflow to start using Airtable. It was easy to adopt on a small scale and integrate it into existing processes, making it a natural fit for teams looking for efficiency without disruption.

For many companies, this flexibility allowed them to experiment with Airtable in small, low-risk settings. As they realized how well Airtable fit into their current ecosystem, its use expanded to other teams, driving company-wide adoption without the need for Airtable to reach out directly.

The Land-and-Expand Model

Airtable’s growth followed a land-and-expand model, where small teams within large organizations adopted the tool independently. Over time, as more teams saw its value, it expanded to become a standard tool across the entire company. This strategy was highly effective because it didn’t require a top-down decision from executives or IT departments to implement.

Instead, the decision to use Airtable often started at the grassroots level—teams that found Airtable useful would advocate for its broader adoption. As companies saw its impact on productivity, they upgraded to paid plans for advanced features and larger-scale usage. This organic, internal growth helped Airtable land some of its biggest clients without the need for direct outreach.

Airtable’s Financial Growth and Analysis

Airtable’s success is not just about how it gained traction through word-of-mouth and product-led growth—it’s also reflected in its financial performance. As more companies adopted the platform, Airtable's valuation and revenue growth soared, placing it among the top players in the tech startup space. Let’s dive into a financial analysis of Airtable and see how its strategic decisions have paid off.

Funding and Valuation

Since its founding in 2013, Airtable has raised substantial funding from prominent venture capital firms. Some key funding milestones include:

2015: Airtable raised its Series A round of $8 million led by CRV.

2018: Airtable closed its Series C round, securing $100 million, which brought its valuation to $1.1 billion, marking it as a unicorn startup.

2020: Airtable raised another $185 million in a Series D round, boosting its valuation to $2.5 billion.

2021: Airtable raised $735 million in Series F funding, pushing its valuation to an impressive $11 billion.

The sheer scale of these funding rounds underscores the high confidence investors have in Airtable’s growth potential. The company’s valuation has grown exponentially as it continues to expand its customer base and roll out new features.

Revenue Growth

While Airtable doesn’t disclose specific revenue figures, it’s clear that the company’s revenue model is driven by its freemium pricing structure:

Free Tier: Users can access core features without any cost, making it easy for small teams or individual users to get started.

Paid Tiers: As teams grow and require advanced features—such as automation, integrations, and increased storage—they can upgrade to paid plans. Airtable offers tiered pricing, starting from $10 per user per month for the Plus plan and $20 per user per month for the Pro plan, with custom pricing for larger enterprises.

The freemium model, coupled with the platform’s land-and-expand strategy, has led to significant revenue growth as small teams scale up to organization-wide adoption, upgrading to higher-tier plans. According to estimates, Airtable has been generating hundreds of millions of dollars in annual recurring revenue (ARR), a key metric for SaaS companies.

Profitability and Long-Term Potential

While Airtable’s focus has been on growth rather than immediate profitability, its business model positions it for long-term financial sustainability. The SaaS (Software as a Service) model, with its recurring subscription revenue, is highly scalable. As more teams adopt Airtable, and existing customers upgrade to higher tiers, revenue continues to grow without a corresponding increase in operational costs. This scalability bodes well for Airtable’s future profitability.

Airtable’s product-led growth model also means that it spends significantly less on customer acquisition compared to companies that rely on large sales teams or marketing budgets. This lower customer acquisition cost (CAC) helps Airtable maintain strong financial efficiency.

Market Competition and Future Growth

Airtable competes with other popular tools like Asana, Trello, Monday.com, and Notion, but its unique positioning as both a spreadsheet-like platform and a relational database gives it a competitive edge. As more companies seek flexible, customizable tools to manage their workflows, Airtable is well-positioned to capture even more market share in the years to come.

Given its current valuation of $11 billion, Airtable is considered one of the leading "unicorns" in the tech space. However, the company is still in growth mode, expanding its feature set, improving integrations, and pursuing enterprise customers. With over 300,000 companies already using Airtable—including major clients like Netflix, Shopify, and Time Magazine—Airtable’s financial future looks bright.